How is the yield on machinery calculated for rental fleet?

How much does a piece of machinery make? How is the yield on machinery calculated? If (my) the fleet size is expanded, will it be profitable?

Is acquiring a particular type of machine a good investment?

These are very common questions when managing any type of company, but are especially pertinent to a rental company. In the rental business, the fleet is the key point of the service. Without the appropriate fleet type and size, the determination of which is an important strategic choice, it is impossible to (serve/meet) satisfy customer utilization demands,

Financial and strategic assessment

We know that there are some machine-units and accessories available for hire to the prime rental operator thus making it unnecessary to buy a specific item just in order to have it on hand; cross-hiring fills the purpose in many cases.

However, during the course of normal business activity, the question of whether or not to buy a particular item or items eventually comes up, in which case the assessment of the ‘financial yield of machinery’ becomes a strategic as well as a financial one.

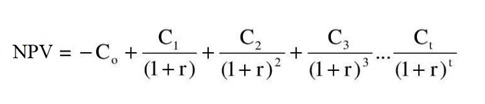

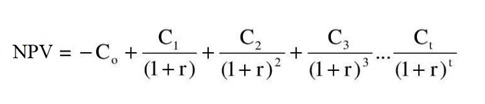

In order to assess the correct worth of a single machine, or a family of machines, it is helpful in the decision-making process to use a financially-weighted calculation; a classical example being Net Present Value (NPV).

Before explaining what it is, and how NPV is calculated, we need to introduce a short and useful concept: ‘an euro today is worth more than an euro tomorrow’.

Why?

- an euro invested today makes interest tomorrow (opportunity cost)

- an euro today is safe; tomorrow is unknown (risk factor)

- an euro today buys goods which are of immediate use (time preference)

- an euro tomorrow is worth less today due to inflation (devaluation effect)

To understand whether or not an investment will be profitable in the long term, we need a process to adjust the future income and cost data and align them to make them comparable.

This ‘actualization’ process can be defined as the present value at a time t = 0 of a future unitary amount. It is the inverse of the capitalization process. Actualizing future values is called ‘discounting’, which is the process of converting a value received in a future time period to an equivalent value received immediately.

Definition

Net Present Value (NPV) is the difference between the sum of the future actualized cash inflows and the sum of the future actualized cash outflows over a period of time.

What does this mean?

Suppose you perform a manual activity for which there is also the opportunity to carry out this same activity with machinery at the same time. The machinery has the potential to generate a profit, but their purchase involves a considerable outlay of capital

The difference between future cash inflow and outflow is the future profit that you disappate on making by purchasing the machines.

A possibile route is to take the sum of the future profit and compare it with the purchase price. But that would be wrong because of the adage: ‘an euro today is worth more than an euro tomorrow’.

Using the NPV formula, you can ‘actualize’ or ‘discount’ the future profit and call it the ‘zero moment’, i.e. the moment you buy the machinery.

The sum of discounted profit gives you the data that you need to understand if you are going to earn anything, and if the investment is more profitable than some other investment.

NPV formula:

C0 = initial investment

Ct = profit in the year ‘ t ‘ (for example: C2 is the profit for the second year)

r = discount rate

An example:

Using rental fleets help us to better understand how to calculate the yield on machinery in rental fleets.

Say you are a small rental company with mostly elevated platforms and vans, but you frequently need a mini-excavator. You have resolved the problem in the past by using ‘cross hire’ — but with the growth of the demand and business, you consider buying a mini-excavator for € 20000. Market research and future usage projection show the machine to have an annual utilization rate ranging from 30% to 45%, and a projected average life of 5 years.

Returning to our formula:

You want an estimate of the future cash flow and future profit, so you take into account the rental revenue after subtracting all the costs involving maintenance, managing, insurance and so forth…

For ‘revenue estimate’, you can use the data of trade associations such as ERA European Rental Association. For cost estimates you can use the historical series from your company history and data from your supplier.

When you estimate revenue and costs you have this profit flow:

C0 = € 20000

| C1 | C2 | C3 | C4 | C5 |

| € 3.800 | € 4.800 | € 5.700 | € 5.500 | € 4.400 |

Using a 4% discount rate, the discounted flow becomes:

| C1 | C2 | C3 | C4 | C5 |

| € 3.800 | € 4.800 | € 5.700 | € 5.500 | € 4.400 |

| 1,04 | 1,08 | 1,12 | 1,17 | 1,22 |

| € 3.654 | € 4.438 | € 5.067 | € 4.701 | € 3.616 |

The sum of the discounted flow is € 21477. NPV is: -20000 + 21477 = € 1477.

Investment evaluation

About the example, we need to ask some questions:

- Does using NPV yield positive results?

Yes, it does.

- How much does the investment make?

7% over five years.

- Is that too much or too little?

When we decided to use 4% as the discount rate, we hypothesised that the investment was a normal financial product yielding 4% per year. The resulting compound interest on the original € 20000 thus becomes € 24333, but although our investment does give a positive result, in this case it doesn’t satisfy the usually anticipated financial gains.

Some considerations

We have used a simple example to explain how machinery yield is calculated using the NPV equation. The values in the example were deliberately chosen to illustrate some financial considerations. In reality, the calculations are much more complex.

The hard part is estimating costs and revenues.

In the case of large fleets, a decision-maker will often reason along the lines of product family. Strategic decisions need to take into consideration the industrial and commercial aspects existing at the time — factors which weren’t considered in this example.

Summing up

NPV is an excellent evaluation tool because it allows machinery values to be estimated in a rational way and, when faced with multiple choices, simplifies otherwise difficult decisions.